Goods and Services Tax is a comprehensive tax levied on supply of goods and services across India. GST is a destination based consumption tax, and the taxable event is supply as against the existing taxable events of sale, manufacture or provision of service.

1. What is Goods and Services Tax?

2. What is the framework that the GST follows?

3. What are the benefits of GST?

4. Who are the taxable persons under GST?

5. What is a GSTIN?

6. What is Reverse Charge?

7. How taxes are charged before and after GST?

What is Goods and Services Tax?

GST is a single uniform indirect tax which was introduced to replace Central and State indirect taxes such as VAT, CENVAT, and others. GST applies on all types of businesses, small or large. This makes it one of the greatest tax reforms in the country. The entire nation will follow a unified tax structure.

As the name suggests, GST will be applicable on both goods and services and India will follow a dual system of GST to keep both the Centre and State independent of each other. The GST council will be headed by the Union Finance Minister and it will consist of various State Finance Ministers. GST will be devised as a four-tiered tax structure with tax slabs of 5%, 12%, 18%, and 28% for various different categories of products and services. 0% rate is kept for most essential goods such as rice, wheat.

What is the framework that the GST follows?

India will follow the dual form of GST, like other countries such as Canada and Brazil. At the intra-state level, where goods and services are sold within the state, CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax) will be levied.

When selling goods and services into other states (inter-state sales), IGST (Integrated Goods and Services Tax) will be levied. Importing goods will come under IGST as it will be considered as inter-state supply. Imported goods will also attract basic customs duty.

Exports and supplies to SEZ, however, will be zero-rated.

What are the benefits of GST?

GST will simplify taxation system in the entire nation and this will help in removal of the cascading tax effect. Cascading effect refers to tax to be paid on a tax. Under GST, this will no longer happen as the unified tax will bring the entire indirect tax system under one umbrella.

Another important benefit is that under GST, the input tax credit can be availed on both goods and services, which eliminates the cascading effect.

GST will also unify the returns and compliances as there will no separate VAT and service tax.

Who are the taxable persons under GST?

A person who carries out any business at any place in India and who is registered or required to be registered under the GST Act. Amongst others, GST registration is mandatory for :

a) Any business whose turnover in a financial year exceeds Rs 20 lakhs (Rs 10 lakhs for North Eastern and hill states)

b) An input service distributor

c) An E-commerce operator or aggregator

d) A person who supplies via e-commerce aggregator

What is a GSTIN?

GSTIN refers to the unique GST identification number that every business will be allotted. Every taxpayer will be allotted a state-wise, PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). Also, note that having PAN is mandatory for register under GST.

What is Reverse Charge?

Usually, when the supplier supplies goods, the tax is levied upon the supplier. In certain cases, the tax is levied upon the buyer of the goods. This is called reverse charge as the chargeability of tax gets reversed.

This is not new under GST, as under the previous VAT regime, the reverse charge existed, but only on services. Now, under GST, it will be applicable on goods as well.

How taxes are charged before and after GST?

Before : Taxes paid by the dealer (Excise) to the manufacturer is added to the cost. When the dealer sells down the chain, VAT keeps getting charged on the sum of actual product cost + excise component, and the VAT keeps getting levied at every point of sale, till it reaches the end customer.

After : Taxes paid by dealer (CGST + SGST) to manufacturer is not added to cost. This is because GST allows the dealer to set off the tax liability of CGST + SGST. This is one of the fundamental features of GST, which allows seamless credit from manufacturer to dealer, and eliminates the cascading effect of taxes.

Quick links

Helps you in managing your business better

Hitech BillSoft is India's most simple and powerful billing software comes loaded with features like sales management, purchase bills, supplier accounts, barcode generator, biometric attendance, staff salary, reminders, pos printer support, android app, and many more to support your business.

Quick review

NEW

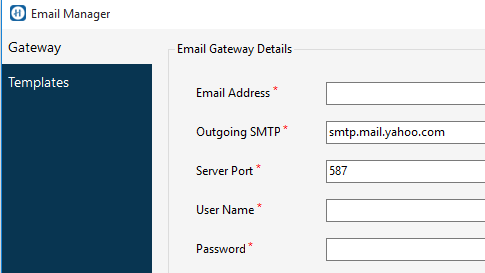

SMS/Email Support

Our billing software comes integrated with SMS/Email server which helps in better communication with your clients.

NEW

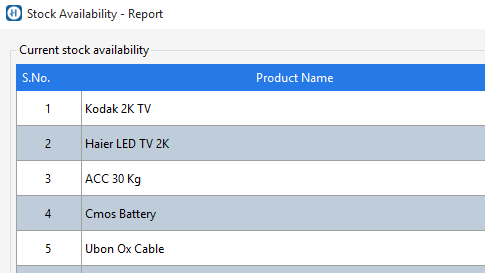

Inventory Tracking

Hitech BillSoft helps in tracking stock movements, purchase bills, supplier accounts, low stock alerts, fast moving goods, and many more.

NEW

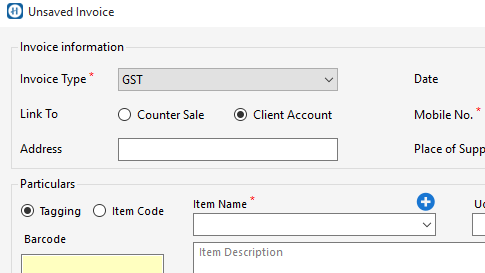

Multi-size Invoices

Our billing software comes with multiple size invoice templates which allows to print invoices in A4, A5 and PoS Receipt (upto 4 inch.) sizes.

Billing becomes more easier.

Download Hitech BillSoft latest version from anywhere, and it's free. Supports Windows 7, 8, 10 and 11.

DOWNLOAD FREE EDITION

*Paid version also available with lifetime validity.