Goods and Services Tax (GST) now a reality in India, and businesses across the country should be conversant with GST related terms, important definitions as specified by the GST Council.

Additional Cess : It is the extra charge levied upon certain goods for the first five years post GST roll out, in order to compensate for any loss of revenue borne by the State government that may arise due to the uniformity and reduction of tax rates associated with demerit goods under the GST.

Address of Delivery : It means the address of the recipient as noted in the files of the supplier. This may or may not be the same as the address of delivery.

Adjudicating Authority : It means any authority competent to pass any order or decision relating to the GST Act, but does not include the Central Board of Excise and Customs, the revision authority, authority for the advance ruling, appellate authority for an advance ruling, appellate authority, or the appellate tribunal.

Aggregate Turnover : It means the total value of all taxable supplies, exempt supplies, exports of goods and/or services, and interstate supplies of a person having the same PAN, computed on the pan-India basis and excluding taxes. However, the value of inward supplies on which taxation is based on reverse-charge mechanism shall not be admitted.

Appellate Tribunal : It means the Goods and Services Tax Appellate Tribunal set up under the GST Act.

Application Service Providers (ASPs) : They are like GST Suvidha Providers (GSPs) but are more wholesome than GSPs. The support provided by ASPs will address most taxpayer compliance difficulties as they work as a liaison between the taxpayers and the GSPs.

ARN Number : It is the unique number generated after a successful GST enrolment or transaction on the GST common portal.

Assessment of Tax Liability : It is the process of calculating tax liability of a specific taxpayer based on the outward and inward supplies details furnished by them on the GST portal.

B2B / B to B : Transaction carried out between two or more registered persons.

B2C / B to C : Transaction carried out between a registered person and one or more unregistered persons.

Bill of Supply : It is a non-formal document issued by a supplier of GST exempted goods/services or by a composition dealer. The bill of supply doesn’t contain any tax information.

Capital Goods : Those items which are purchased and used for doing/developing a business (for sale/to generate income). It also includes those items for which a taxpayer has claimed input tax credit.

Cash Ledger : It is one of the subsidiary ledgers that are maintained by a company alongside the general ledger. As the name says ‘cash’, this ledger is a record of all transactions associated to cash accounts that are operated by an organization and its branches.

CGST : Tax levied by the Centre on the intrastate (within state/UT) transactions of taxable goods and services.

Common Portal : It refers to the online GST portal approved by the Central and State Governments, on the recommendation of the council.

Composite Supply : It means a supply consisting of two or more goods and/or services, which are naturally bundled and provided together, one being a principal supply.

Composition Scheme : It is a special scheme for small businesses with turnover less than 1 Crore that involves paying tax at a fixed rate of annual income rather than at normal GST rates.

Credit Note : It is a document issued by a taxable person in relation to the tax invoice exceeding the taxable value and/or tax payable in respect of supply, or where the goods supplied are returned by the recipient, or where the services supplied are found to be deficient.

Debit Note : It means a document issued by a taxable person relating to the taxable value and/or tax charged as per the tax invoice when found to be less than the taxable value and/or tax payable in respect of such supply.

Digital Signature Certificate (DSC) : It refers to a secure digital key that certifies the identity of the holder, issued by a Certifying Authority. It typically holds information about the identity of the holder. It is the digital equivalent of a handwritten signature.

E-commerce Operator : It refers to businesses that offer an online marketplace where other vendors can sell goods to customers.

E-Way Bill : It is an electronic (digital) bill required to be produced to facilitate the movements of goods with the value above Rs.50,000.

Exempted Supply : It means supply of any goods and/or services that are not taxable and includes such supply of goods and/or services that attract zero rate of tax or that may be exempt from tax.

Forward Charge : It is the tax liability of the supplier of goods and/or services to levy the tax on the recipient of the goods and/or services and to remit the same to the credit of the government.

Goods and Services Tax Network (GSTN) : It is a non-profit, public-private partnership company. Its main purpose is to provide IT infrastructure and services to Central and State Governments, taxpayers, and other stakeholders to facilitate the implementation of GST.

GST Council : It is the council designated by the Indian government with the task to govern the GST, decide GST rules and ensure proper implementation of GST in the country.

GST Suvidha Provider (GSP) : It refers to third-party applications that assist the taxable person in accessing the GST portal in an enriched manner by being more user-friendly and customer-centred.

GST Tax Invoice : It is the GST compliant tax document to be issued by the registered supplier to the recipient of taxable goods and services on which GST has been charged.

GSTIN Number : It is a unique PAN-based 15-digit number given to a taxpayer registered under the GST law.

GSTR 1 : GST return form used for furnishing the details of outward supplies (sales) on the common portal.

GSTR 2 : GST return form for providing the details on inward supplies (purchases) on the GST portal.

GSTR 3 : GST return form used by a normal taxpayer for entering the details of tax liability and making payment of tax on the GST Portal.

GSTR 4 : GST return form to be used by composition registered dealers for filing their quarterly GST returns on the portal.

Harmonized System Nomenclature (HSN) Code : It is a numeral used to classify goods for taxation purposes provided by the World Customs Organization.

IGST : It is the integrated tax levied by the Centre on the interstate (between two states/UTs) transactions of taxable goods and services.

Input Tax Credit : It is the credit against the tax already paid on inputs (purchases) can be claimed back to pay the liability of output taxes (on sales). It is called input tax credit or ITC.

Interstate Supply : It means the supply of goods / services during interstate (between two states) trade or commerce.

Intrastate Supply : It means the supply of goods / services during intrastate (within same state) trade or commerce.

Inward Supply : It refers to the receipt of goods and/or services, whether by purchase, acquisition, or any other means, and with or without any consideration.

Mixed Supply : It means two or more individual supplies of goods and/or services made together by a taxable person for a single price where such supply does not form a composite supply.

Non-Resident Taxable Person : It is someone who occasionally undertakes transactions involving the supply of goods and/or services, whether as principal or agent, or in any other capacity, but with no fixed place of business in India.

Output Tax : It means the CGST/SGST on taxable supply of goods and/or services made by a taxable person or by his agent. Excludes tax payable on a reverse-charge basis.

Outward Supply : It refers to the supply of goods and/or services, whether by sale, transfer, barter, exchange, licence, rental, lease, or disposal, or any other means made or agreed to be made during business.

Principal Place of Business : It means the location of business specified as the principal place of business in the certificate of registration.

Principal Supply : It means the supply of goods and/or services that form the significant element of a composite supply and any other related supply being ancillary.

Receipt Voucher : It is a GST compliant voucher or casual bill issued by a GST registered manufacturer/supplier upon receiving advance payment for a future supply. It works as the proof of receipt of payment.

Refund Voucher : It is a GST compliant voucher to be issued by the manufacturer/supplier upon cancellation of an order on which an advance has been paid by the recipient. It is the proof that the advance payment has been refunded back to the recipient.

Reverse Charge : It means the tax liability on the recipient of the supply of goods and/or services instead of the supplier of such goods and/or services.

Services Accounting Code (SAC) : It is a method of nomenclature that will be used to identify, classify and define services under the GST.

Services : It means anything other than goods, money and securities but includes activities relating to the use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged.

SGST : It is the GST levied by the States on the intrastate (within one state) transactions of taxable goods and services.

Supply : It includes all forms of supply of goods and/or services such as sale, transfer, barter, exchange, license, rental, lease, or disposal made or agreed to be made for a consideration by a person in the course of business and also includes import of services for a consideration whether or not in the course of business.

Taxable Person : It is an individual who carries on any business at any place in any state of India and who is registered or required to be registered under GST.

UIN / Unique Identity Number : It is an ID that is used to identify specialized agencies who are non-taxable on Indian soil. These agencies can be bodies of United Nations, consulates, foreign embassies or organizations that are exempted either by the UN or by our government(s).

UTGST : It is is the GST levied by the Union Territory on the intrastate (within one UT) transactions of taxable goods and services.

Zero-Rated Supply : It means supply of any goods and/or services including export of goods or services or both or supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Quick links

Helps you in managing your business better

Hitech BillSoft is India's most simple and powerful billing software comes loaded with features like sales management, purchase bills, supplier accounts, barcode generator, biometric attendance, staff salary, reminders, pos printer support, android app, and many more to support your business.

Quick review

NEW

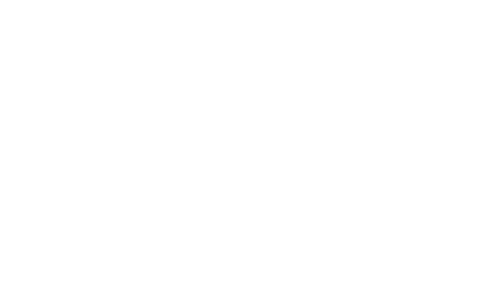

SMS/Email Support

Our billing software comes integrated with SMS/Email server which helps in better communication with your clients.

NEW

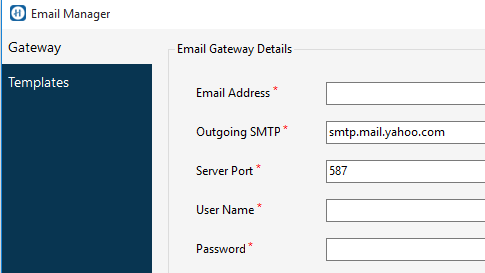

Inventory Tracking

Hitech BillSoft helps in tracking stock movements, purchase bills, supplier accounts, low stock alerts, fast moving goods, and many more.

NEW

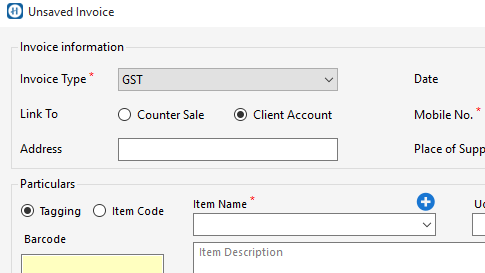

Multi-size Invoices

Our billing software comes with multiple size invoice templates which allows to print invoices in A4, A5 and PoS Receipt (upto 4 inch.) sizes.

Billing becomes more easier.

Download Hitech BillSoft latest version from anywhere, and it's free. Supports Windows 7, 8, 10 and 11.

DOWNLOAD FREE EDITION

*Paid version also available with lifetime validity.