GST Composition Scheme

Hitech BillSoft helps you in billing even if you

are registered for composition scheme.

Free Version Download

Composition Scheme is a simple and easy scheme under GST designed for taxpayers with small turnovers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than ₹ 1.5 crore

1. Who can register for Composition Scheme?

2. Who cannot register for Composition Scheme?

3. What are requirements for availing Composition Scheme?

4. How can a taxpayer avail Composition Scheme?

5. How should a Composition Dealer issue bill?

6. What are the returns to be filed by a composition dealer?

7. What are the advantages of Composition Scheme?

8. What are the disadvantages of Composition Scheme?

Who can register for Composition Scheme?

A taxpayer whose turnover is below ₹ 1.5 crore can opt for Composition Scheme. In case of North-Eastern states and Himachal Pradesh, the limit is now ₹ 75 lakh.

Turnover of all businesses registered with the same PAN should be taken into consideration to calculate turnover.

Who cannot register for Composition Scheme?

The following people cannot opt for the scheme :

1. Supplier of services other than restaurant related services.

2. Manufacturer of ice cream, pan masala, or tobacco.

3. Casual taxable person or a non-resident taxable person.

4. Businesses which supply goods through an e-commerce operator.

What are requirements for availing Composition Scheme?

The following are the requirement thats need to be fulfilled in order to avail composition scheme :

1. Input Tax Credit cannot be claimed by a dealer opting for composition scheme.

2. Dealer cannot make any inter-state supply of goods.

3. The dealer is not allowed to supply GST exempted goods.

4. Taxpayer has to pay tax at normal rates for transactions under reverse charge mechanism.

5. If a taxable person has different segments of businesses (such as textile, electronic accessories, groceries, etc.) under the same PAN, they must register all such businesses under the scheme collectively or opt out of the scheme.

6. The taxpayer has to mention the words 'composition taxable person' on every notice or signboard displayed prominently at their place of business.

7. The taxpayer has to mention the words 'composition taxable person' on every bill of supply issued by him.

How can a taxpayer avail composition scheme?

For availing composition scheme a taxpayer has to file GST CMP-02 with the Government of India.

This intimation should be given at the beginning of every Financial Year by a dealer wanting to opt for Composition Scheme.

How should a Composition Dealer issue bill?

Composition dealer is not allowed to issue tax invoice. This is because a composition dealer cannot charge tax on sales from their customers. Hence, the dealer has to issue a Bill of Supply instead of tax invoice.

The dealer should also mention 'composition taxable person, not eligible to collect tax on supplies' on Bill of Supply.

What are the returns to be filed by a composition dealer?

A composition dealer is required to file a quarterly return GSTR-4 by 18th of the month after the end of the quarter. Also, an annual return GSTR-9A has to be filed by 31st December of next financial year.

What are the advantages of Composition Scheme?

The following are the advantages of availing composition scheme :

1. Lesser compliance needed(returns, maintaining books of record, issuance of invoices).

2. Limited tax liability.

3. High liquidity as taxes are charged at a lower rate.

What are the disadvantages of Composition Scheme?

The following are the disadvantages of availing composition scheme :

1. Business can be done in same state only as dealer is barred from carrying out inter-state transactions

2. Input Tax Credit is not available to composition dealers.

3. Taxpayer will not be eligible to supply exempt goods or goods through an e-commerce portal.

Quick links

Helps you in managing your business better

Hitech BillSoft is India's most simple and powerful billing software comes loaded with features like sales management, purchase bills, supplier accounts, barcode generator, biometric attendance, staff salary, reminders, pos printer support, android app, and many more to support your business.

Quick review

NEW

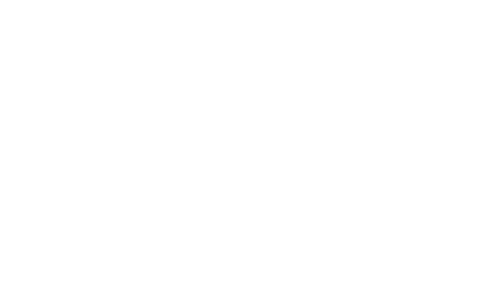

SMS/Email Support

Our billing software comes integrated with SMS/Email server which helps in better communication with your clients.

NEW

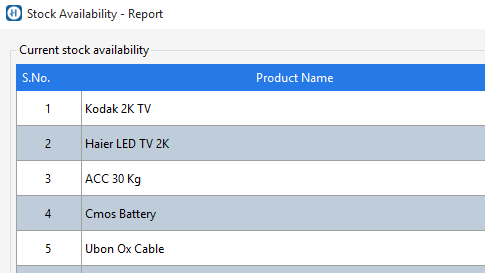

Inventory Tracking

Hitech BillSoft helps in tracking stock movements, purchase bills, supplier accounts, low stock alerts, fast moving goods, and many more.

NEW

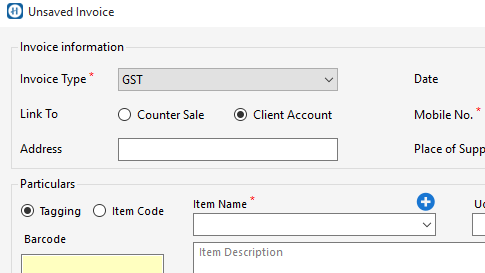

Multi-size Invoices

Our billing software comes with multiple size invoice templates which allows to print invoices in A4, A5 and PoS Receipt (upto 4 inch.) sizes.

Billing becomes more easier.

Download Hitech BillSoft latest version from anywhere, and it's free. Supports Windows 7, 8, 10 and 11.

DOWNLOAD FREE EDITION

*Paid version also available with lifetime validity.